Introduction

When launching a firm, business, or corporation, one of the most important decisions is determining the best organizational structure. This decision has implications for a variety of factors, including tax responsibilities, startup fees, personal liability, paperwork, and registration processes. The legal framework within which an organization functions in a given country is referred to as its corporate structure. This legal framework governs the organization's ability to raise capital, manage tasks, and fulfill tax requirements. In Nigeria, the most frequent business structures are sole proprietorships, partnerships, public limited liability corporations, and private limited liability companies.

Factors in Selecting a Business Structure

Choosing the correct business structure is critical, and it is determined by criteria such as required licenses and permissions, tax duties, setup expenses, personal liability, business control, and paperwork. As firms grow, owners may decide to alter their business structure to better meet their changing demands.

A. SOLE PROPRIETORSHIP

A sole proprietorship is the simplest type of business, as it is owned and controlled by one person. It is simple to set up and inexpensive, but it carries unlimited liability, which means the owner is entirely accountable for any debts and choices. Many firms in Nigeria use this structure since it is simple. However, it has considerable disadvantages, including no continuity if the owner dies, trouble obtaining financing, and a lack of separation between business and personal funds.

Sole proprietorship is a type of unincorporated business that is privately owned and run by one person. A sole proprietorship is the simplest form of business structure because it is very simple and easy to set up, it has unlimited liability due to the fact that the business has not been formally registered as a company. As a sole proprietor, you are legally responsible for all aspects of your business including any debts and losses and day-to-day business decisions. Most of the businesses that are run in Nigeria are in the hands of the sole proprietorship and it is the first business structure that comes to mind when setting up a business in Nigeria.

The Simplicity, Full Profit Retention and the Unlimited personal liability of sole proprietorship

A sole proprietorship is a business conducted and owned by a single person who has complete control over the operation and keeps all earnings. One of the primary advantages of this business structure is its inexpensive start-up cost, which makes it accessible to many prospective entrepreneurs. Furthermore, sole proprietorships often pay lesser taxes and fees than other business kinds.

Even with its benefits, a sole proprietorship has a number of disadvantages. One major problem is that there is no succession plan in place, so when the owner passes away, the company frequently fails. Additionally, the proprietor is subject to limitless liability, which means that company debts may be settled with personal assets. There is frequently no obvious distinction between personal and business funds, and poor record-keeping and financial management can have a detrimental effect on the company. Furthermore, because investors typically prefer to work with corporations rather than sole proprietorships, obtaining loans or additional cash might be difficult.

Taxation of a sole proprietorship in Nigeria

In Nigeria, sole owners are subject to the Personal Income Tax Act (PITA), which requires them to pay PIT on their earnings. This tax applies to all income sources, including corporate earnings, salaries, wages, and other forms of compensation. Sole owners are responsible for filing tax forms and paying taxes on time, as required by PITA.

B. PARTNERSHIP

Section 1(1) of the Partnership Act states that a Partnership is the relation which subsists between persons carrying on a business in common with a view to making profit. A partnership consists of two or more people managing and conducting a business together. It is more complicated than a sole proprietorship, but still reasonably simple to set up. Partners divide earnings, debts, and responsibilities in accordance with their agreement. Partnerships allow for collective decision-making, which can result in better outcomes, but they also carry the danger of disagreements and infinite liability. There are several categories of partners, including active, inactive, nominal, and limited partners, each with unique tasks and obligations.

Understanding the Structure and Implications of Partnership Businesses.

A partnership business in Nigeria is characterized by joint ownership, where the business is owned by two to twenty people, and in the case of banking, by two to ten individuals. The capital for the business comes from the contributions of partners, guided by a legal agreement that also dictates the lifespan of the partnership. Active partners manage the business, making decisions jointly, which often leads to better outcomes through collaborative efforts.

However, partnerships come with certain disadvantages. Partners face unlimited liabilities, meaning they are personally liable for the business's debts, even potentially using their own assets. Disagreements between partners can arise, and the actions of one partner are binding on the others. Additionally, the death of a partner might lead to the dissolution of the business.

The types of partners in a firm vary based on their activity level and liability. An active partner participates in daily operations and acts as an agent for the others, while a dormant or sleeping partner does not engage in daily activities but shares in the profits and losses. A nominal partner lends their name to the partnership without contributing capital or sharing in the profits, and a limited partner contributes capital but is legally restricted from participating in management.

Registration Of A Partnership Business In Nigeria

Registering a partnership business in Nigeria involves securing a business name with the Corporate Affairs Commission (CAC), submitting a name reservation form, and presenting a partnership deed. The deed outlines essential details such as the business name, location, partner identities, business nature, capital contributions, and provisions for the continuation of the business in the event of a partner's death or withdrawal. After submitting the required documents, it typically takes two to four weeks to receive a certificate of incorporation, allowing the business to commence operations.

Taxation Of A Partnership Business In Nigeria

Regarding taxation, a partnership itself is not taxed; instead, the profit share of each partner is subject to tax. Partners are liable for Personal Income Tax (PIT) and must comply with Value Added Tax (VAT) regulations, which involve collecting and remitting VAT on goods and services to the Federal Inland Revenue Service (FIRS). Capital Gains Tax is also applicable when the partnership sells an asset at a gain, with a 10% tax on the chargeable gains.

VAT in Nigeria, governed by the Value Added Tax Act, is primarily borne by the final consumer and must be remitted to FIRS by the 21st of the month following the transaction. There are distinctions between Input VAT, paid on raw materials and goods for resale, and Output VAT, charged on goods and services supplied. Certain goods and services, such as medical products, basic food items, and educational materials, are exempt from VAT. Additionally, expenditures directly related to the acquisition, enhancement, or disposal of assets are deductible from the sales consideration under Capital Gains Tax.

C. LIMITED LIABILITY PARTNERSHIP

The scope and nature of business enterprises in Lagos State have changed with the creation of Limited Partnerships under the Partnership Law of Lagos State. The introduction of Limited Liability Partnerships has given impetus to the general law of Partnerships in the State. The Partnership Law of Lagos State 2003 which was amended in 2009 provided for the Limited liability partnership (LLP).

The Limited Liability Partnership is provided for under Part 4 of The Partnership Law of Lagos State 2009 and it is subject to the conditions provided for under the Partnership Law.

Limited liability partnerships can be regarded as the combination of the benefits of a corporate structure such as limited liability companies with that of a partnership structure. It is simply a combination of both to form one.

Requirements And Registration Of A Limited Liability Partnership

According to Part 3, Section 58 of the Partnership Law of Lagos State 2019, to register a Limited Liability Partnership (LLP), several conditions must be met. First, two or more persons intending to carry on a lawful business for profit must subscribe their names to a registration document, which must be delivered to the Registrar along with a copy of any partnership agreement. A statement confirming compliance with this requirement, made by a solicitor or one of the subscribers, must also be submitted, along with evidence of payment for the initial registration fees. The registration document itself must include specific details such as the LLP's name, the state where its registered office will be located, the address of the registered office, the names and addresses of all partners, and an indication of which partners will be designated as Limited Liability Partners.

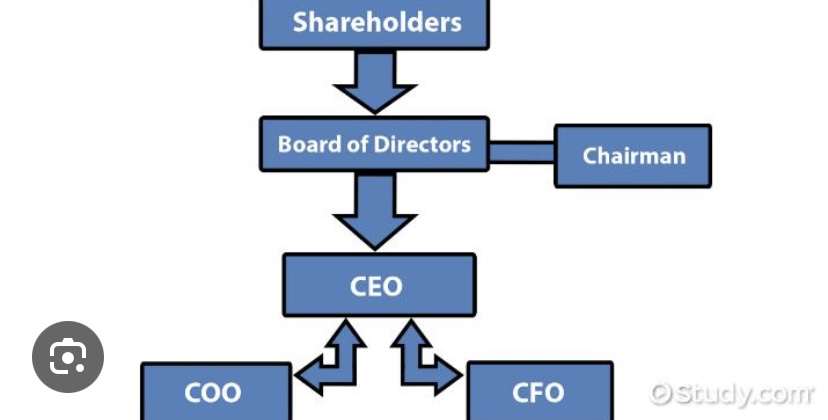

PUBLIC LIMITED COMPANY

A public limited liability can be defined as a company that has the ability to sell its shares to the public through the stock exchange. These type of companies have offered to the public the opportunity to subscribe to its shares and become shareholders thereby being part of the owners of the company. Examples of public limited companies in Nigeria are Dangote Cement plc, Dangote Sugar plc, Fidelity Bank plc, and A.G Leventis Nigeria plc

Characteristics And Advantages Of A Public Limited Company

- A Public Limited Company end with the word “Plc” at the end of its name

- People with relevant professional certification or experience in similar industries may be appointed as its company secretary

- The minimal quantity of directors is three

- If a person is over 70 years of age and is able to fulfil certain statutory conditions may be appointed as one of the directors of the company

- It is necessary for a Public Limited Company to hold a statutory meeting within 6 months of its establishment

- A Public Limited Company can invite the public to subscribe for shares or debentures of the company provided it is listed on the floor of the Nigerian Stock Exchange

- Public Limited Companies can therefore raise money via IPO’s or Public Offers

- A company listed on the floor of the Nigerian Stock Exchange must be a Public Limited Company but not all Public Limited Company must be listed

- Shareholders of Public Limited Companies must be a minimum of 50

- Shares in a public liability company are more transferrable

- There is opportunity for growth and expansion due to the large amount of capital resources available to it

Disadvantages Of A Public Limited Company

- It is vulnerable to a takeover if majority of the shareholders agree to a bid

- There is control and ownership issues

- Registering a public limited liability company requires complying with lots of regulatory requirement

Registration Of A Public Limited Company In Nigeria

According to the Corporate Affair Commission, which is the regulating authority on the establishment and management of companies in Nigeria, certain documents must be kept ready for a quick and easy establishment of a company. These documents are:

- Names, addresses, phone numbers and email addresses and shareholding percentage of each shareholder

- Name, address, phone number and email address of the Professional Company Secretary

- Name, addresses, phone numbers and email addresses of Directors (minimum of two adult directors)

- The Proposed Company address.

- The Proposed share capital of the company (N500,000 at the least)

- Means of identification for the directors, shareholders and Company Secretary to a copy of international passport, permanent voters card, national id card or driver’s license

- Objects of the Company, i.e. business the Company proposes to operate

- Memorandum and Articles of Association of the Company

PRIVATE LIMITED COMPANY

A private limited company is a separate legal entity on its own which means it is separate from its owners and shareholders. It has a simplicity of structure and the personal possessions of the shareholders are considered as separate from that of the company. Private limited company do not offer their shares for public subscription

Registration Of A Private Limited Company In Nigeria

To register a private limited company in Nigeria, the following criteria must be met

- The name of your company should not be exactly identical to the name of any other company currently being held in the registry of the Corporate Affairs Commission, Nigeria

- The total members in a private limited company should not be more than 50.

- During the incorporation of the company, a minimum of 25% of the total shares should be allocated.

- A minimum of two people who are above the age of 18 must be a part of the article of association and the memorandum of associations.

- The company should keep an office in Nigeria which should be registered beforehand.

- A minimum of N10,000 should be authorised as the share capital of the company

- The following documents must also be provided according to the Corporate Affairs Commission (CAC)

- Identification such as an I.D card, Voters card or Driver’s License issued by the government

- Proficiency Certificate (if the business is a consultancy or hospital)

- Note of name Reservation from CAC, Nigeria

- Receipt of payment from CAC

- Stamp Duty Certificate from FIRS

- Residence Permit (for Foreigner shareholders)

Characteristics And Advantages Of A Private Limited Company

- There is continued existence. The death of any individual doesn’t bring the business to a stop

- The name of a private company limited by shares shall end with the word “Limited” or ‘’Ltd’’

- A private company must have a minimum of two shareholders and a maximum of 50

- Limited liability available to its shareholders

- It is a separate entity. It has the right to sue and be sued

Disadvantages Of A Private Limited Company

- The registration process is costly and it takes time

- There is division of ownership

- Restriction on public participation in subscribing for shares

Taxation Of Public And Private Limited Company

In Nigeria, both private and public limited corporations must pay a number of taxes, such as Company Income Tax (CIT), which is applied at a rate of thirty percent to taxable profits. Income from a variety of sources, including trade, real estate rentals, dividends, and other gains, is subject to this tax. In addition, these businesses must pay personal income tax (PIT) to their employees and value added tax (VAT) at the rate of 7.5% on goods and services that are subject to VAT. Businesses are also obligated to comply with Withholding Tax (WHT) regulations and pay 10% Capital Gains Tax (CGT) on their asset sales proceeds.

Conclusion

Each business structure comes with different procedures, documentations, taxation and registration. Their set up differs from one another. Business owners must ensure that before setting up a business, they consider the type of settings in a business structure that will go along with the type of business they want to set. They must consider certain factors like the cost of setting up the business, registration procedures and taxes to sure that the business runs smoothly.