Navigating the Legal Landscape for E-hailing Startups in Nigeria: A Comprehensive Guide

Introduction:

Starting an e-hailing tech startup in Nigeria presents exciting opportunities but also requires navigating a complex legal landscape. Ensuring compliance with regulations, protecting intellectual property, and selecting the right business structure are critical to long-term success. Under the Companies and Allied Matters Act (CAMA), the registration process for a Limited Liability Company (LLC) is straightforward, but knowing the right steps and legal obligations can prevent unnecessary setbacks. This article outlines the specific steps for registering an LLC under CAMA and key legal requirements to help entrepreneurs establish a strong foundation for their startup.

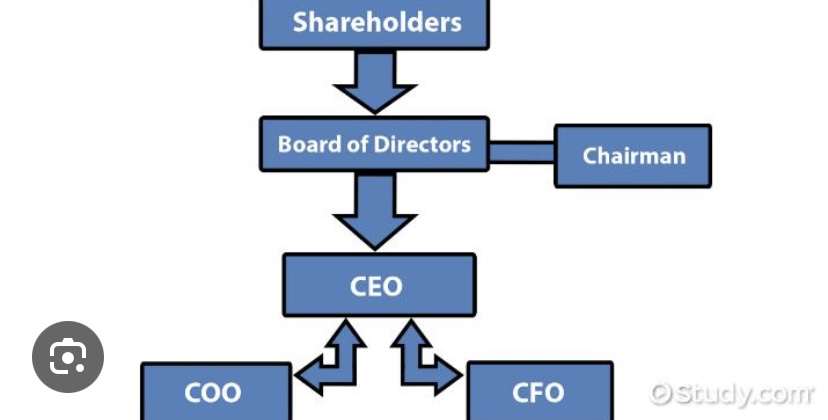

For an e-hailing tech startup in Nigeria, a Limited Liability Company (LLC) is generally the most suitable business structure. An LLC offers several advantages, including:

Limited liability:Shareholders are not personally liable for the company's debts or liabilities.

Tax flexibility:LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation, providing flexibility based on the company's specific needs.

Ease of formation: The process of forming an LLC is relatively straightforward compared to other business structures.

Separate legal entity:An LLC is a separate legal entity from its owners, providing a layer of protection.

To register a Limited Liability Company (LLC) under the Companies and Allied Matters Act (CAMA) in Nigeria, the following steps are typically followed:

1. Choose a Unique Company Name

First, the company must propose a unique name and verify its availability through the Corporate Affairs Commission (CAC) portal. If available, a name reservation is made, valid for 60 days.

2. Prepare the Required Documentation**

Memorandum and Articles of Association (MEMART):

This outlines the business objectives and regulations governing internal management.

Details of Shareholders and Directors: Minimum of 2 directors is required. Details like their full names, addresses, and national identification numbers (TIN, NIN, or passport) must be provided.

Registered Office Address:A physical office address in Nigeria is required for correspondence and legal notices.

Share Capital: The minimum authorized share capital for an LLC in Nigeria is typically ₦100,000 (higher for specialized sectors).

3. Complete the CAC Forms

Form CAC1.1 (Application for Registration of a Company): Includes information on the company's name, type, registered office address, details of the directors, secretary, shareholders, and share capital structure.

Form CAC 2.1: Statement of share capital and return of allotment.

Form CAC 7: Particulars of directors.

4. Pay the Statutory Fees

Fees for name reservation, incorporation filing, and stamp duties must be paid online via the CAC platform or designated bank.

5. Submit Documents to CAC

All completed forms, including the MEMART, identification documents, and receipts of payments, are submitted electronically through the CAC portal.

6. Obtain the Certificate of Incorporation

Once the application is reviewed and approved by the CAC, the company will receive a Certificate of Incorporation, which officially confirms the legal existence of the LLC. Along with the certificate, the company will receive a Tax Identification Number (TIN) for tax purposes.

7. Comply with Post-Incorporation Requirements

After incorporation, the company must hold its first Annual General Meeting (AGM) within 18 months and file annual returns with the CAC to maintain compliance.

These steps ensure the proper legal establishment of a company under CAMA and the protection of the founders' personal assets through limited liability.

E-hailing startups in Nigeria must comply with various legal requirements and regulations, including:

Business registration:The startup must be registered with the Corporate Affairs Commission (CAC) as a Limited Liability Company.

Tax Registration: Registering with the Federal Inland Revenue Service (FIRS) for a tax identification number (TIN) is crucial, as is complying with tax deadlines to avoid penalties. Tech startups can also take advantage of incentives under the Nigeria Startup Act, which provides tax breaks for innovative businesses.

Data protection:The startup must comply with Nigeria's data protection laws, such as the Data Protection Regulation (DPR), to protect user data.

Transportation regulations: The startup may need to obtain specific licenses or permits from state transportation authorities to operate as an e-hailing service.

Road traffic regulations: The startup must ensure that its drivers comply with all road traffic laws and regulations.

To protect its intellectual property, the startup can:

Obtain copyright protection: Copyright protection is automatically granted to original works, including the mobile app's code and design.

Register a trademark: The startup can register its brand name and logo as a trademark to protect them from unauthorized use.

Apply for a patent: If the startup has a unique and innovative technology, it can apply for a patent to protect its invention.

Confidentiality agreements: The startup should have confidentiality agreements in place with employees, contractors, and investors to protect its confidential information.

Some potential challenges and risks associated with operating an e-hailing tech startup in Nigeria include:

Regulatory hurdles: The regulatory landscape for e-hailing services in Nigeria can be complex and subject to change.

Competition: The e-hailing market in Nigeria is highly competitive, with established players and new entrants.

Infrastructure challenges: Nigeria's infrastructure, such as roads and internet connectivity, can pose challenges for the operation of e-hailing services.

Security concerns: Ensuring the safety and security of passengers and drivers is a major concern for e-hailing startups.

Economic fluctuations:The Nigerian economy can be volatile, which can impact the demand for e-hailing services.

The specific licenses and permits required to operate an e-hailing service in Nigeria may vary depending on the state or region. However, some common requirements include:

Operating license: A license from the relevant state transportation authority.

Vehicle registration:Registration of vehicles used for e-hailing services.

Driver permits:Valid driver's licenses for drivers.

Insurance: Adequate insurance coverage for vehicles and passengers.

Conclusion:

Registering an e-hailing tech startup as a Limited Liability Company (LLC) in Nigeria offers many advantages, from limited liability protection to tax flexibility. However, understanding the legal steps involved under the Companies and Allied Matters Act (CAMA) is crucial for ensuring compliance and protecting the company’s assets. Following the outlined steps, from choosing a unique company name to obtaining the certificate of incorporation, ensures a smooth registration process. With the right legal framework in place, startups can focus on innovation and growth, while remaining compliant with Nigeria’s legal and regulatory requirements

References:

Aderonke Alex-Adedipe, Legal guide to navigate the tech startup scene in Nigeria<https://furtherafrica.com/2024/05/08/legal-guide-for-navigate-the-tech-startup-scene-in-nigeria/> accessed on 10 September,2024.

Berkeley Legal, Legal Requirements for Startups & Tech firms in Nigeria: Part 2<https://berkeleylp.com/insights/legal-requirements-for-startups-in-nigeria/> accessed on 10 September,2024