INTRODUCTION

In Nigeria, launching a business may be a thrilling and difficult experience. Setting up a strong basis for your startup and avoiding potential pitfalls need skillful navigation of the legal landscape.

Comprehending and adhering to legal mandates guarantees your company runs efficiently and enhances your trust with partners, investors, and clients.

This article shall focus on a group of entrepreneurs preparing to launch a new ride-hailing technology venture, it is critical to grasp the legal framework that governs such operations in Nigeria. We shall vehemently provide detailed guidance on the best business structure, legal requirements, intellectual property protection, potential challenges, and licenses for the venture.

THE LEGAL ESSENTIALS E-HAILING TECHNOLOGY SHOULD BE AWARE OF

A) Business Incorporation and Business Registration

1. Business Structure

Given the nature of the startup and its long-term growth potential in Nigeria, the most appropriate business form for an e-ride hailing tech startup is a Limited Liability Company (LLC).

This is a sort of business structure provides limited liability protection to its owners (shareholders). The company has a separate legal personality, which means it is liable for its activities. Also, pertinent to establish that this type of registration can be private or public limited liability company but, in this regards, E-ride Hailing Technology considering Public Liability Company (Plc) is best fit for purpose.

A public limited liability is a type of business structure that offer shares to the general public via the stock exchange. These businesses give the general public the chance to subscribe for their shares and become shareholders, becoming a part of the company's ownership.

Some of the advantages of running Public Limited Company are as follows:

- A Public Limited Company end with the word “Plc” at the end of its name as provided in Section 29 of CAMA 2020

- People with relevant professional certification or experience in similar industries may be appointed as its company secretary

- The minimal quantity of directors is three

- If a person is over 70 years of age and is able to fulfil certain statutory conditions may be appointed as one of the directors of the company

- It is necessary for a Public Limited Company to hold a statutory meeting within 6 months of its establishment

- A Public Limited Company can invite the public to subscribe for shares or debentures of the company provided it is listed on the floor of the Nigerian Stock Exchange

- Public Limited Companies can therefore raise money via IPO’s or Public Offers

- A company listed on the floor of the Nigerian Stock Exchange must be a Public Limited Company but not all Public Limited Company must be listed

- Shareholders of Public Limited Companies must be a minimum of 50

- Shares in a public liability company are more transferrable

- There is opportunity for growth and expansion due to the large amount of capital resources available to it.

Although,

- Plc must comply with stringent regulatory requirements since they are held to a higher standard, which can be costly and time-consuming.

- Stock market share values can fluctuate significantly according to market conditions, economic variables, industry trends, and company-specific news.

- Plc are compelled to publish detailed financial and operational information to the public, revealing sensitive corporate strategies and perhaps providing insights to competitors.

2. Business Registration

According to the Corporate Affair Commission (CAC), which is the regulating authority on the establishment and management of companies in Nigeria, certain documents must be kept ready for a quick and easy establishment of a company. These documents are:

- Names, addresses, phone numbers and email addresses and shareholding percentage of each shareholder

- Name, address, phone number and email address of the Professional Company Secretary

- Name, addresses, phone numbers and email addresses of Directors (minimum of two adult directors)

- The Proposed Company address.

- The Proposed share capital of the company (spilt among shareholders – note that people with 5% shares and above will be made persons of significant control in the company)

- Means of identification for the directors, shareholders and Company Secretary to a copy of international passport, permanent voter’s card, national id card or driver’s license

- Objects of the Company, i.e. business the Company proposes to operate

- Memorandum and Articles of Association of the Company

B) Legal Regulations Compliance

1. Compliance with Tax Regulations.

Understanding and complying with tax regulations is crucial for avoiding legal issues and penalties. Key tax considerations include:

- TAX IDENTIFICATION NUMBER (TIN)

E-ride Hailing Transportation must obtain a TIN from the Federal Inland Revenue Service (FIRS). This is required for all tax-related transactions i.e. in other to register for taxes, including Company Income Tax (CIT), Value Added Tax (VAT), Bank Account Opening, Regulatory Compliance, among others, E-ride Hailing Transportation needs to obtain Taz Identification Number (TIN).

- COMPANY INCOME TAX

E-ride Hailing Transportation is subjected to Company Income Tax (CIT) on profits, is assessed and payable on a preceding year basis, subject to the rule on commencement, cessation of business and change of accounting date. The tax authority responsible for the administration of the Company income tax regime in Nigeria is the Federal Inland Revenue Service (FIRS) established pursuant to section 1 of the Federal Inland Revenue service (establishment) Act. Where taxable, the applicable rate is 30% of the taxable profit.

According to section 9 of the Company Income Tax (CIT) Act, the profits of any company accruing, derived from, brought into, or received in Nigeria are taxable in Nigeria. The sources of such profits include’

- Any trade or business

- Rent or premium earned from right granted to any other person for the use or occupation of any property

- Dividends, interest, royalties, discounts, charges or annuities

- Any source of annual profits or gains not falling within any of the afore mentioned category;

- Fees, dues, and allowances (wherever paid) for services rendered

- Any profit or gains arising from acquisition and disposal of short-term money instruments like Federal Government securities, treasury bills etc.

For Nigerian companies, by virtue of Section 13(1) of CITA, CIT is chargeable on their global income.

- VALUE ADDED TAX (VAT)

E-ride Hailing Transportation under the Federal Inland Revenue Service (FIRS) is consider as a taxable services, and requires operators to register for VAT and remit VAT on their transactions. So, as such, since it deals with VATable services are liable to pay VAT which is 7.5% in Nigeria.

- PERSONAL INCOME TAX (PIT)

Employees working in a Public limited company, in this regards E-ride Hailing Transportation Plc are to also pay taxes on their income. Personal income tax is also applicable to Director’s Remuneration, Shareholders’ Dividends, Benefits-in-kind (it applies to benefits-in-kind provided to employees and directors, such as vehicles or phones), Tax Clearance Certificate (TCC) – in other for company to operate, etc.

- WITHHOLDING TAX (WHT)

This is also applicable to either be it Private Limited companies or Public Limited Companies, is application is on payments made on drivers – who are considered independent contractors, vendors – such as maintenance services or fuel suppliers, dividends distributed to shareholders, applies to rent paid on leased assets and royalties paid on intellectual property, etc.

- CAPITAL GAINS TAX (CGT)

This is also applicable at a rate of 10% on sales of Assets – i.e. gains from the sale of company assets, such as vehicles, equipment, or property, disposal of subsidiaries – that is gains from the disposal of subsidiaries or investments, share buybacks – gains from share buybacks or redemption of shares, gains from mergers and acquisitions, tax liability – liable to pay CGT on gains made from the disposal of assets, also may be eligible for exemptions & reliefs, such as rollover relief or exemption relief, among others.

2. Compliance with the Nigerian Companies and Allied Matters Act (CAMA) 2020

A Public Limited Liability Company (Plc) is subject to particular legal requirements and regulations under the Companies and Allied Matters Act (CAMA) 2020, which regulate its incorporation, operations, corporate governance, and regulatory compliance. A number of legal requirements must be satisfied in order for an e-ride hailing transportation company operating in Nigeria as a Public Limited Liability company (Plc) to function within the bounds of Nigerian law. The following must be considered:

1. Company Incorporation Requirement

To function legally as a Public Limited Liability Company (PLC), the e-ride hailing company must register with the Corporate Affairs Commission (CAC). CAMA 2020 governs the incorporation process, outlining the following processes and legal requirements:

a) The required minimum share capital: In Nigeria, S27 of the CAMA 2020 provided that a public liability company needs to have ₦2,000,000 as the minimum authorized share capital. Public subscriptions for the company's shares are required to account for a minimum of 25% of the share capital at the time of establishment.

b) The Total Amount of Owners: There must be 50 shareholders minimum for a public firm. These stockholders may be people, businesses, or organizations. A Plc may have an unlimited number of shareholders.

c) Required Minimum of Directors: A minimum of two directors must be appointed by the firm in accordance with S271 of CAMA 2020. The directors are accountable for supervising the company's administration and operations, formulating strategic plans, and guaranteeing adherence to regulations.

d) Designation of a Company Secretary: Every publicly traded company needs to appoint a company secretary who possesses the necessary training, experience, or professional certification. In order to maintain corporate governance and regulatory compliance, the company secretary is essential and being appointed among the directors – Section 6 (2) & (4) of the CAMA 2020

e) The Articles of Association and Memorandum: The company's goals, internal governance guidelines, and the duties and rights of directors and shareholders must all be outlined in the Memorandum and Articles of Association – Section 27, CAMA 2020.

f) Incorporation Document Submission: The following are the incorporation documents that the CAC requires as provided for in Chapter 2 of the CAMA 2020:

- Application for Registration of a Company, Form CAC 1.1

- Memorandum and Articles of Association;

- Director, Shareholder, and Company Secretary Identity Documents (National ID, Passport, etc.);

- Statement of conformity, attested to by a lawyer attesting to conformity with CAMA 2020 standards.

2. Requirements for Corporate Governance

CAMA 2020 imposes strict corporate governance guidelines for public firms. These regulations guarantee openness, responsibility, and moral leadership—qualities that are especially crucial for businesses with public investors.

a) Annual General Meetings (AGMs): Obligation to organize Annual General Meetings (AGMs), during which shareholders discuss and approve critical items such as the company's financial statements, dividend payments, and board elections. The company must also present audited financial statements to shareholders at AGMs.

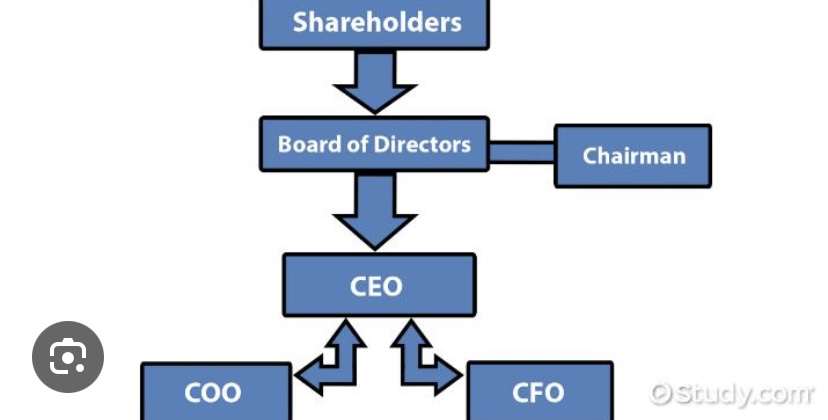

b) Board of Directors, Committees: The Board of Directors must meet on a regular basis to make crucial operational decisions for the organization. CAMA 2020 fosters the development of specialist board committees, including:

- Audit Committee,

- Corporate Governance, and

- Remuneration Committee.

These committees help oversee and manage various elements of the company.

c) Filling out annual returns: A public liability company must submit annual returns to the CAC to affirm its ongoing existence and disclose information about its financial situation, shareholders, and directors. This filing assures continued regulatory compliance and transparency.

d) Appointing independent auditors: Under CAMA 2020, public firms must engage independent auditors to review their financial statements. These auditors must be approved by the shareholders at the AGM.

3. Taxation and Financial Reports

The e-ride hailing transportation company must follow tax and financial reporting requirements outlined in CAMA 2020 and other relevant Nigerian tax legislation.

a) Corporate Income Tax (CIT): Public enterprises must pay 30% Company Income Tax (CIT) on their taxable profits. Small companies (with a turnover of less than ₦25 million) may be eligible for a lower CIT rate.

b) Value-Added Tax (VAT): The company must collect and remit VAT at a rate of 7.5% on services offered to clients. This pertains to e-hailing services, which are taxed under Nigerian VAT laws.

c) Tax registration: The company must register with the Federal Inland Revenue Service (FIRS) for all taxes, including VAT and CIT, and get a Taxpayer Identification Number (TIN). Taxes must be paid according to the schedule established by Federal Inland Revenue Service (FIRS).

d) Financial statements: The company is expected to prepare audited financial statements on an annual basis that meet international financial reporting standards (IFRS). These financial statements must be presented to shareholders at both the AGM and the CAC.

3. Compliance with Traffic Regulations

E-ride hailing transportation company must follow the National Road Traffic Regulations, which govern the operation of automobiles on Nigerian roadways. This includes ensuring that vehicles are roadworthy, properly insured, and drivers follow traffic laws. For instance, in Lagos, e-ride hailing transportation must adhere to the Lagos State E-hailing Regulations 2020, which were published by the Lagos State Government. The regulation prescribes the following requirements:

- Operator License: Must get an Operator License, which has various tiers dependent on the number of vehicles in their fleet.

- Driver Registration: All drivers using the platform must be registered with the Lagos State Ministry of Transportation and have a valid driver's license.

- Vehicle Inspection: The vehicles must undergo periodic safety inspections and meet state-mandated safety requirements.

- Service Charges: The regulations mandate e-hailing platforms to pay the Lagos State Government a service fee based on a percentage of transaction fares.

- Compliance with Data Protection Regulation

Large volumes of personal data from drivers and passengers will be handled by your company (Plc) providing e-ride hailing services in Nigeria. It is pertinent to follow the Nigeria Data Protection Act (NDPA), 2023 when collecting, processing, storing, and safeguarding personal information. Respecting the NDPA is essential since breaking it can lead to serious fines and harm to your business's reputation. An extensive guide to the NDPR's legal requirements and regulations for your e-ride hailing business can be found below.

2. Lawful Basis for Data Processing:

In pursuant to S25 of the Nigeria Data Protection Act (NDPA), 2023 provided that company must make sure that all data processing activities have a legal basis. According to the provision, personal data may be processed if:

The data subject (driver or passenger) has given explicit consent;

the processing is required to comply with a legal obligation;

the processing is necessary to perform a contract with the data subject;

the processing is necessary to protect the data subject's vital interests;

it is done in the public interest or in the exercise of official authority; or the data subject has given explicit consent.

In regard to an e-hailing service, the majority of data processing will be based on contractual requirement (such as trip bookings) or user consent for marketing and other non-essential data uses.

3. Data Processing and Security Protocols

E-hailing company must put in place the proper organizational and technical safeguards in accordance with the NDPA to protect customer information against abuse, unauthorized access, and data breaches. Your company ought to:

- Protect sensitive data with encryption, particularly location and financial data.

- Use access control to limit authorized personnel's access to data.

- To detect and reduce risks, regularly do data protection impact assessments, or DPIAs.

- To stop data loss or corruption, implement secure data storage systems.

- To secure user accounts, utilize robust authentication techniques like two-factor authentication (2FA).

4. Data Subject Rights

Under the NDPA 2023, individuals (drivers and passengers) have certain rights that your company is required to uphold. These rights include the following:

- the Right to Access, which allows drivers and passengers to request access to their personal data and a copy of it within a reasonable time;

- the Right to Rectification, which allows individuals to request that inaccurate or incomplete data be corrected;

- the Right to Erasure (Right to be Forgotten), which allows people to request that their personal data be erased when it is no longer needed for the original purpose;

- the Right to Object, which allows individuals to object to the processing of their data for specific purposes, like direct marketing; and

- the Right to Data Portability, drivers and passengers are entitled to receive their personal information in a format that is widely used and to transfer it to another service provider.

Your startup must put in place effective procedures to handle requests for data access, update data, delete data as needed, and enable data portability in order to abide by these rights.

5. Policies for Data Retention and Minimization

According to the NDPA, only information that is required for processing should be gathered. Data must not be kept around for longer than is required. Your business ought to:

- Adopt data minimization strategies to ensure that you are only gathering the data necessary to provide your services.

- Create a data retention policy that outlines how long personal information will be kept on file and how to remove or anonymize information that is no longer required.

For example, location data might only need to be kept for a short time for legal or auditing purposes, after which it should be erased.

4. Compliance with the Federal Competition and Consumer Protection Act 2019 (FCCPA)

The main laws governing fair trade, competition, and consumer protection in Nigeria are explicitly discuss in the Federal Competition and Consumer Protection Act (FCCPA) 2019. In order to maintain a competitive market and safeguard consumer rights, it formed the Federal Competition and Consumer Protection Commission (FCCPC). Adherence to the FCCPA is essential for an e-ride hailing transport company functioning as a Public Liability Company (Plc) in Nigeria.

In order to maintain lawful operations, encourage fair competition, and protect the interests of customers, your e-ride hailing business must abide by the major legal requirements and restrictions outlined in this paper under the FCCPA.

- Affiliating with the FCCPC

E-hailing service operating in the transportation sector needs to register with the FCCPC. To ensure compliance with competition and consumer protection rules, the FCCPA mandates that all enterprises operating in Nigeria, particularly those engaged in consumer-facing activities, register with the commission.

- The company must give comprehensive details regarding its operations, ownership structure, and services.

- By registering, you make sure that your business is kept under observation to make sure it complies with consumer protection and fair competition laws.

2. Fair Competition and Anti-Competitive Practices

In Nigeria, the FCCPA aims to uphold and encourage fair competition. As an e-ride-hailing business subject to public liability, you have to refrain from actions that can be seen as monopolistic or anti-competitive. This comprises:

a) Imposing Monopolistic Conduct

It is forbidden for your business to misuse its market dominance by:

- Preventing rivals from joining or staying in the market.

- Using predatory pricing, which involves cutting prices below the mark to oust rivals.

- Making drivers or riders subject to unfair trading terms.

b) Acquisitions and Mergers

Any acquisition or merger by your business that could significantly reduce competition needs to be reported to and approved by the FCCPC. This covers situations in which your business plans to buy out or combine with another transportation-related business.

c) Fixing Prices

S107 of the FCCPA 2019 provided that companies are not allowed to enter into contracts with rival businesses to fix pricing or participate in market-sharing arrangements that would undermine competition under the FCCPA. The pricing of ride-hailing services must be set by market forces, taking into account supply and demand.

3. Standards for Consumer Protection

Since e-ride hailing company deals directly with customers, they have a need to abide by all FCCPA regulations pertaining to consumer protection. Important responsibilities consist of:

a) Right to High-Quality and Safe Services

It is necessary for your business to offer customers dependable and safe transportation services. Both the municipal transport authority and the FCCPC have set safety and quality requirements that drivers and vehicles must adhere to. It is crucial to properly vet drivers and perform routine maintenance on cars.

b) Transparency and Disclosure

The FCCPA requires that information about the services being provided to customers be clear, accurate, and comprehensive. This comprises:

- Transparent pricing: Clearly displaying on the app the ride prices, surcharges, and available payment methods.

- Terms of service: Giving travelers clear terms and conditions that cover things like insurance coverage, cancellation policies, and dispute resolution procedures.

- Receipt of service: After every ride, sending out e-receipts or alerts with the fare and other pertinent costs listed.

c) Ethical Business Conduct

It is vital for your organization to guarantee that all promotional, marketing, and advertising efforts are truthful and not deceptive. Under the FCCPA, making false statements regarding the caliber of the service, safety precautions, or cost may result in penalties.

d) Method for Consumer Complaints

The FCCPA places a strong emphasis on consumers’ right to be heard. A dependable and easily accessible mechanism for resolving customer complaints must be established by your business. It must be simple for customers to file concerns about the caliber of the services, the cost, or any other concern. In addition, the FCCPC could demand that your business provide reports on the way in which customer complaints are addressed and settled.

e) Privacy and Security of Data

The FCCPA safeguards customers' right to privacy in addition to the Nigeria Data Protection Regulation (NDPR), which controls the protection of personal data. Your organization is responsible for making sure that all passenger and driver data, including ride history and personal information, is kept private and used only for appropriate business needs. The FCCPA penalises the unauthorised disclosure of or misuse of customer data.

4. Prohibition of Unfair Trade Practices

Any kind of consumer-harming exploitation or unfair activities must be avoided by your e-ride hailing business. The following unfair trading practices are forbidden by the FCCPA:

- Price Gouging: The practice of artificially inflating ride prices without a valid reason by taking advantage of emergencies or periods of high demand.

- Bait and Switch Tactics: Making false claims about reduced costs or exclusive offers that are not actually available, or imposing additional fees that were not first revealed.

- Unfair Contract Terms: Including clauses in your contract that unfairly benefit your business at the expense of customers, including ambiguous refund or cancellation policies.

5. Sanctions and Penalties for Failure to Comply

Serious consequences may result from breaking the FCCPA's rules, including:

- Fines: Businesses that break competition or consumer protection regulations may be subject to fines from the FCCPC. These penalties may be high, particularly when there has been consumer exploitation or anti-competitive activity.

- Service Suspension: If a corporation is discovered to be engaging in detrimental or persistently non-compliant actions, the FCCPC has the right to suspend or withdraw licenses or permits.

- Criminal Prosecution: In severe circumstances, directors or important firm personnel may be charged with a crime for flagrant FCCPA infractions.

INTELLECTUAL PROPERTY PROTECTION ON A HAILING TECH STARTUP IN NIGERIA

The e-hailing transportation startup's innovations and its competitive edge are crucially protected by intellectual property (IP), particularly when it comes to areas like the mobile app, business plan, and brand identification. Your startup can protect its intellectual property (IP) under Nigerian law by utilising a variety of legal frameworks as a Public Liability Company (Plc). So the question, how will your startup intellectual property be protected?

- Protection of Mobile Application

A vital component of any e-hailing transportation firm is the mobile app. It is the interface that drivers use to get job notifications and clients use to book rides. The app is protected by the following intellectual property rights:

a) Copyright

What It Protects: The mobile app’s design, software code, and other creative elements are all protected by copyright. The app’s developer or owner company receives exclusive rights to manage the app's replication, distribution, and alteration.

How to Secure Copyright: When an original work is created in Nigeria, copyright protection is automatically granted. However, it is a good idea to formally register the copyright of the app with the Nigerian Copyright Commission (NCC). In the event that there is an infringement, this gives greater legal footing. Your startup makes sure that no one may lawfully duplicate or redistribute the program without authorisation by protecting copyright.

b) Patents

What It Protects: If your mobile app has novel technological features or methods—for example, an exclusive ride allocation algorithm, real-time traffic updates, or payment processing—you may be able to patent these innovations. A patent grants the startup the exclusive right to use and commercialise the innovation for 20 years.

How to Secure a Patent: You can file for a patent with the Nigerian Ministry of Industry, Trade, and Investment's Patents and Designs Registry. If granted, no other business will be able to use your patented technology without your consent.

c) Trade Secrets

What It Protects: Trade secrets may be applied to proprietary techniques or algorithms that are essential to the mobile app's operation. This includes ride matching or price strategy optimisation through backend procedures, user data algorithms, or machine learning models.

How to Keep Trade Secrets Safe: Tight internal controls and non-disclosure agreements (NDAs) safeguard trade secrets. NDAs should be signed by all parties involved in the development of the app, including staff members, independent contractors, and outside developers, to guard against illegal disclosure of private data.

2. Protection of the Business Model

An e-hailing transportation startup's business model consists of its overall plan for matching drivers and passengers, how fares are calculated, how money is made (through commissions and other fees), and how operations are carried out. Although the business model as a whole might not be immediately patentable or copyrightable, certain parts of it can be:

a) Patent for Business Methods

What It Guards Against: If they satisfy the requirements for innovation and industrial applicability, unique components of the business model—like the ride-matching algorithm, payment gateway integration, or certain techniques for ride-sharing optimization—may be eligible for patent protection.

Ways to Obtain a Patent: Business method patents need to be submitted to the Patents and Designs Registry, much as technological patents. Once awarded, rivals will be unable to employ comparable techniques without violating your patent.

b) Trademarks

What It Protects: Trademark law provides protection for your company's name, logo, slogan, and other branding components utilised in business model marketing. An e-hailing business needs a strong brand to become well-known in the marketplace and win over devoted users.

How to Protect Your Brand: It is necessary to register trademarks with Nigeria's Trademarks, Patents and Designs Registry. By registering a trademark, you make sure that no other business may use a name or logo that is similar to yours, confusing consumers or weakening your brand.

c) Copyright Protection for User Interface and Marketing Materials

What It Protects: Creative works like ads, website content, promotional movies, and user interface designs that are used to market a business concept can be protected by copyright. These components are essential for setting the e-hailing platform apart in the crowded industry.

How to Ensure Copyright Protection: These creative works are automatically protected by law from the moment of production, much like the app, but formal registration with the Nigerian Copyright Commission (NCC) offers further legal protection.

3. Licensing and Commercialization of IP

Once your intellectual property is protected, your startup can make additional cash through licensing agreements. For example, your patented app technology or business technique might be licensed to other e-hailing platforms in Nigeria or elsewhere. Licensing helps you to expand your market reach while preserving ownership of your intellectual property.

Your trademarks and brand can also be licensed for use in co-branded marketing campaigns, partnerships, or product merchandising, giving you more chances to commercialize your intellectual property.

4. Legal Enforcement and Intellectual Property Infringement Protection

The startup's intellectual property must be constantly monitored and enforced to prevent unauthorized usage or violation. If another company tries to copy your mobile app, business techniques, or brand identification, you can take legal action to protect your interests.

- Legal Recourse: Depending on the specifics of the infraction, you may be able to sue for copyright, trademark, or patent infringement under Nigerian law. IP disputes are heard by the Federal High Court, and winning cases can lead to awards of money, restraining orders, and orders to cease infringing activities.

- Border Control Measures: You can collaborate with Nigerian Customs to use the Trademarks Act and other pertinent customs enforcement procedures to stop the importation of products that violate your intellectual property rights if counterfeit goods—such as unlicensed merchandise bearing your brand—threaten your rights.

POTENTIAL CHALLENGES AND RISKS FOR A NEW HAILING TECH STARTUP IN NIGERIA

Stating a Public Limited Liability Company (PLC) in Nigeria to operate a ride-hailing technology firm offers a number of risks and hurdles in addition to big business prospects. Using pertinent data and legal considerations from the Nigerian business environment, concentrating on the unique legal, operational, financial, and regulatory challenges that the entrepreneurs may encounter. Let’s take adequate consideration of the following:

- Regulatory and Licensing Challenges

a) Compliance with State-Specific Laws and Regulations

Nigeria's ride-hailing market is strictly regulated, especially in major business hubs like Lagos State. For example, ride-hailing businesses must comply with the Lagos State E-Hailing Regulations 2020, which mandate licensing fees, vehicle specifications, and driver registration. Penalties, suspensions, or even the termination of activities may follow noncompliance with state regulations.

Fact: In 2020, the Lagos State Government implemented a new regulatory framework requiring e-hailing companies to pay operator license fees ranging from 10 million to 25 million based on fleet size. In addition, e-hailing businesses must pay the government 10% of the transaction charge for each ride.

Risk: Aside from the fact that the new startup might find wanting, juggling the regulation of each state of operation, these fees and regulatory requirements can put a strain on a startup’s resources, particularly in its early stages, resulting in operating delays or limits.

b) Federal and Local Tax Obligations.

In Nigeria, companies (in this case running a public limited liability companies) are required to pay a variety of federal and state taxes, such as Company Income Tax (CIT), Value Added Tax (VAT), and Withholding Tax. Local governments may also levy particular transportation taxes or charges on e-hailing businesses.

Fact: According to Nigerian tax legislation, corporations must pay 30% of their taxable profits as Company Income Tax and 7.5% VAT on products and services.

Risk: Failure to comply with tax laws may result in harsh penalties from the Federal Inland Revenue Service (FIRS) and municipal tax authorities, such as large fines, reputational harm, and even business suspension.

c) Data Security and Privacy Compliance

The firm will gather and process considerable amounts of personal data, including user information, driver details, and payment data. Compliance with the Nigeria Data Protection Act (NDPA) 2019 is critical for preventing breaches of personal data protection legislation.

Fact: The NDPA requires organizations that process personal data to get user consent, adopt data protection measures, and inform authorities in the event of a data breach. Non-compliance can result in fines of up to 2% of yearly gross income, or ₦10 million, whichever is higher.

Risk: Data breaches or inability to comply with data privacy standards may result in severe financial penalties and harm the company's brand, losing customer trust and market share.

2. Operational and Market Risks

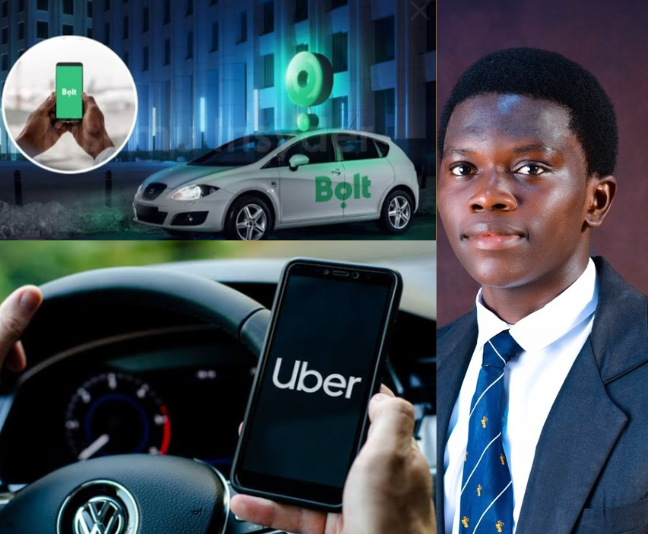

a) Competition from established players.

Nigeria's ride-hailing sector is already very competitive, with established competitors such as Uber and Bolt commanding significant market share. Competing with these enterprises necessitates significant cash investments in marketing, driver incentives, and customer acquisition.

Fact: In 2020, Uber and Bolt controlled more than 80% of the Nigerian ride-hailing market, with thousands of drivers and a well-established customer base.

Risk: A new entrant may struggle to gain market share, and the necessity to offer competitive pricing and promotions may strain financial resources, resulting in extended periods of poor profitability.

b) Reliance on Technological Infrastructure

A ride-hailing startup's success is primarily dependent on the performance and dependability of its mobile app and technology infrastructure. Issues like app downtime, system failures, and bad user experience can all have a substantial impact on operations.

Fact: In 2021, some ride-hailing businesses experienced technological disruptions due to inadequate internet access and server troubles, leading in operational losses.

Risk: Technical failures, particularly during peak hours, may result in consumer and driver losses to competitors. Furthermore, frequent app crashes or data leaks might harm the brand's credibility, lowering its market position.

c) Driver Recruiting and Retention

Recruiting and keeping drivers is a major operational difficulty for ride-hailing companies. Drivers in Nigeria are primarily independent contractors, therefore employers must provide appealing incentives to keep an active driver pool. However, excessive driver turnover and discontent with commission rates can cause disruptions in operations.

Fact: Drivers on e-hailing services frequently complain about hefty commission fees (usually 20-25%), which drastically lower their profits. Additionally, regulatory pressure to maintain proper vehicle inspections and licensing might result in driver shortages.

Risk: Difficulty finding and retaining drivers may result in service disruptions and slower expansion. Furthermore, dissatisfaction among drivers could lead to strikes or legal action, thereby harming the company's public image.

d) Geopolitical and insecurity issues

Operating a ride-hailing business in Nigeria entails dealing with security threats, especially in areas with high levels of crime or insurgency. This can expose both drivers and passengers to threats such as armed robbery, kidnapping, and car theft.

Fact: Nigeria has experienced various security difficulties, particularly in the Northern and Middle Belt regions, which may hinder the extension of services into these areas.

Risk: Increased security risks may lead to increased insurance premiums and additional security measures, which raise operational expenses. Furthermore, frequent security events may cause driver and passenger hesitation, limiting market growth.

3. Financial and Funding challenges

a) Capital Requirements for Expansion.

As a PLC, the corporation can raise cash through public offerings. However, listing on the Nigerian Stock Exchange (NSE) necessitates meeting stringent capital and reporting criteria, which can be expensive and time-consuming.

Fact: To list on the Nigerian Stock Exchange, companies must achieve minimum capital requirements and adhere to strict corporate governance norms. PLCs must also produce financial accounts on a regular basis, which can be costly to manage.

Risk: Meeting the financial and legal requirements for a public listing can put a burden on resources, and failing to comply with NSE listing requirements may result in delisting or penalties.

b) Longer Path to Profitability.

The e-hailing sector frequently works with low margins and significant early investments, such as technology development, marketing, and driver incentives. Achieving profitability may take longer than expected, especially in a highly competitive sector.

Fact: Major ride-hailing businesses like Uber and Lyft needed several years to become profitable, with significant losses in their early years of operations.

Risk: If profitability is not achieved within an acceptable time frame, the firm may face cash flow issues that necessitate future rounds of funding or lead to insolvency.

c) Foreign Exchange Volatility.

As a PLC that intends to expand or attract foreign investors, the company is vulnerable to Nigeria's foreign exchange (FX) volatility. Currency changes can have an influence on the company's capacity to raise cash, import technology, or distribute earnings to overseas shareholders.

Fact: The Naira, Nigeria's currency, has been volatile in recent years due to oil price swings, inflation, and foreign exchange controls.

Risk: A sudden devaluation of the naira or limits on foreign exchange access might have an impact on the company's financial stability, increase operational costs, and diminish investor confidence.

4. Legal and Liability Risks

a) Legal Responsibility for Passenger and Driver Safety.

As a mediator between passengers and drivers, the firm may be held legally liable in the event of an accident, dispute, or criminal conduct involving its drivers. Plaintiffs may seek to hold the firm accountable for any injuries or damages sustained during rides.

Fact: Ride-hailing businesses have faced several lawsuits worldwide over accidents, assault, and conflicts between drivers and riders. In 2020, Uber faced class action lawsuits in several jurisdictions over passenger safety.

Risk: Legal action could result in large financial settlements, regulatory penalties, and reputational harm. The company should establish precise terms of service and get broad liability insurance to helps limit potential dangers.

b) Corporate Governance Requirements

The startup must abide by the corporate governance guidelines set out by the Securities and Exchange Commission (SEC) and the Companies and Allied Matters Act (CAMA) 2020 since it is a public business. These consist of stringent shareholder communications, frequent board meetings, and open financial reporting.

Fact: Public businesses must designate a company secretary, host an annual general meeting (AGM), and have a minimum of three directors as per CAMA 2020.

Risk: Failure to adhere to corporate governance guidelines may result in regulatory organisations imposing penalties, such as a halt to trading on the Nigerian Stock Exchange and harm to one's reputation.

CONCLUSION

To legally operate e-hailing service in Nigeria, the Companies and Allied Matters Act (CAMA) 2020 requires the startup to register with the Corporate Affairs Commission (CAC). Furthermore, state and federal governments require particular licenses and permits. For example, an Operator License (Class A for businesses with more than 1,000 cars and Class B for smaller operators) is required in Lagos State. Vehicles must fulfil roadworthiness standards through routine inspections, and drivers must hold valid licenses and a Lagos State Drivers’ Institute (LASDRI) Certificate. The Federal Capital Territory (Abuja) has comparable regulations, requiring the business to register with the Federal Capital Territory Transport Secretariat.

The startup must also comply with Nigerian Communications Commission (NCC) regulations, as the app relies on telecommunications services. In addition, the company should register for a Tax Identification Number (TIN) with the Federal Inland Revenue Service (FIRS) and adhere to tax laws, including Company Income Tax, Value Added Tax (VAT), and Personal Income Tax for drivers and employees. To handle user data, compliance with the Nigeria Data Protection Regulation (NDPR) 2019 is mandatory, and a Data Protection Officer (DPO) may be required.

Protection of intellectual property (IP) is essential; this includes copyright for mobile apps, trademarks for brands, and possibly patents for platform features that are exclusive. Legal compliance also requires the presence of insurance, such as third-party vehicle insurance and passenger liability insurance. According to Federal Road Safety Corps (FRSC) requirements, health and safety protocols ought to be incorporated into the service.

The business must abide by labour rules, make sure driver contracts are clear, and follow Foreign Direct Investment (FDI) requirements if it is looking to raise money from outside.